It can be stressful but it feels mostly fine even I take a -200K plunge in a single day, because my account has grown to be nearly all "house money". Just pure trading profits and it's not really from saving job income. Now that's not the right mentality to approach trading as it leads to reckless risk taking which I admit to over the past couple greedy months, but it's true.YOU ARE DOWN A MILLION IN THIS 1 month from all time high?!?!???!?!

I’m down 26k and i can’t stop staring at the market. Even that’s been depressing.

Are you constantly worrying about the markets? I know i do. Do you feel constantly stressed about your positions? I sometimes do when I’m heavily concentrated in 1 or 2 positions that are single stocks.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Options and real estate wedlock - a beginner level trade on a real estate backed asset

- Thread starter cyanide12345678

- Start date

I usually just close out and eat the loss immediatley if i face a losing trade. I do trade short puts on earnings for the volatility crush. I've played as short as 1 week DTE to as far as (currently) >1 year expiry.So what exactly are you doing?

how many days to expiration?

how far are you keeping your strikes? What probability of winning are you usually going for?

How much money are you keeping in margin maintenance excess to avoid any margin call?

Are you able to relax on a day where spy is negative 1-2 percent and your account is negative 30-50k?

Are you closing at 40-50 percent profit?

How are you salvaging your losing trades?

Do you avoid selling puts around earnings?

4 years ago, i posted my first ever post regarding selling puts. At that time, you had said a lot of wise words which i didnt even understand at that time. You were also one of the only few people who fundamentally supported the concept of selling puts and understood exactly what my post was about. So yeah… glad to see that you’re killing it.

I have never been margin called, currently I have 870K available. I'm actually planning to close out all leverage tomorrow, after META's destruction in earnings today. I have short puts in META, AMZN, GOOGL, MSFT. (You can reference my 'unrealized gain' screenshot above which displays my current positioning.) And own shares in AMZN currently. I'm leveraged about 5 : 1 by notional value.

Tomorrow i'm going to close out all my short puts and I will plan to just hold pure AMZN shares for now as I'm rapidly deleting my excess profits YTD over this past month. So i plan to be completely deleveraged in the morning.

Yes I traded in and out of SMCI and other shares of other stocks like CRWD or ZS, META etc.Yea I should have been a little more clear. I was talking about his SCMI position as it seems like his naked puts are all smaller bets on positions outside of pure stock big bets on SMCI and AMZN.

Am I reading that first pic correctly? He had a total cumulative cost basis of 13.8 and proceeds of 14.2 for a realized gain of about $400k?

I assume that "W" next to those numbers means wash sales were baked into those figures?

Does that mean he was swinging in and out of pure stock positions? Or also selling naked puts on the underlying and this happens to be the total tally of all those options trades? @wamcp If it's the former, tell us how you approached that!

And also traded in and out of short naked leveraged puts on various tickers.

I traded very heavily each day, but now I do it far less.

I racked up I think paying about -$200K in commission/fees in 2023 across the two brokerages.

- Joined

- May 6, 2020

- Messages

- 281

- Reaction score

- 667

Yes I traded in and out of SMCI and other shares of other stocks like CRWD or ZS, META etc.

And also traded in and out of short naked leveraged puts on various tickers.

I traded very heavily each day, but now I do it far less.

I racked up I think paying about -$200K in commission/fees in 2023 across the two brokerages.

Did you have a handful of swing and intraday strategies to time those SMCI entries and exits?

Maybe some combination of indicators and other TA?

What made you choose to do pure shares for your SMCI and AMZN positions rather than selling puts?

I'm only familiar with direct shares trading since that's what I spent two years doing during the pandemic (intraday and multi-day swing momentum trading, entries and exits based on supports/resistances along with a volume analysis approach I came up with)

- Joined

- Jul 27, 2011

- Messages

- 2,273

- Reaction score

- 2,943

I usually just close out and eat the loss immediatley if i face a losing trade. I do trade short puts on earnings for the volatility crush. I've played as short as 1 week DTE to as far as (currently) >1 year expiry.

I have never been margin called, currently I have 870K available. I'm actually planning to close out all leverage tomorrow, after META's destruction in earnings today. I have short puts in META, AMZN, GOOGL, MSFT. (You can reference my 'unrealized gain' screenshot above which displays my current positioning.) And own shares in AMZN currently. I'm leveraged about 5 : 1 by notional value.

Tomorrow i'm going to close out all my short puts and I will plan to just hold pure AMZN shares for now as I'm rapidly deleting my excess profits YTD over this past month. So i plan to be completely deleveraged in the morning.

Did you basically go 1 year out because vix became decently high?

Why would you do that when theta decay is extremely inefficient when > 1 year out. I used to do these, but now i am very conscious about not going over 90 days.

- Joined

- Jul 27, 2011

- Messages

- 2,273

- Reaction score

- 2,943

I usually just close out and eat the loss immediatley if i face a losing trade. I do trade short puts on earnings for the volatility crush. I've played as short as 1 week DTE to as far as (currently) >1 year expiry.

I have never been margin called, currently I have 870K available. I'm actually planning to close out all leverage tomorrow, after META's destruction in earnings today. I have short puts in META, AMZN, GOOGL, MSFT. (You can reference my 'unrealized gain' screenshot above which displays my current positioning.) And own shares in AMZN currently. I'm leveraged about 5 : 1 by notional value.

Tomorrow i'm going to close out all my short puts and I will plan to just hold pure AMZN shares for now as I'm rapidly deleting my excess profits YTD over this past month. So i plan to be completely deleveraged in the morning.

Good for you for deleveraging when you are far ahead.

3.4 million by age 34 is impressive as hell.

Though tomorrow will likely be rough for you with your tech heavy portfolio.

By the way, public.com may be introducing naked puts soon, and they state that they will pay 18 cents per contract - essential give you half their earnings for order flow. So not only do they not charge a commission, they’ll pay you on top.

Their platform is pretty useless right now since it has no naked position contracts, but they will soon have it. If you paid 200k in commissions, you literally could walk away with thousands of dollars through reduced commissions.

Btw…. Are you paying 0.15 per contract or 0.65? If you’re paying 0.65 per contract then you should be calling those guys and telling them to give you a better rate or you’re leaving.

- Joined

- Jul 27, 2011

- Messages

- 2,273

- Reaction score

- 2,943

Did you have a handful of swing and intraday strategies to time those SMCI entries and exits?

Maybe some combination of indicators and other TA?

What made you choose to do pure shares for your SMCI and AMZN positions rather than selling puts?

I'm only familiar with direct shares trading since that's what I spent two years doing during the pandemic (intraday and multi-day swing momentum trading, entries and exits based on supports/resistances along with a volume analysis approach I came up with)

One of the few ways to create immense wealth is by heavy concentration.

Selling puts would normally not give you 100-200 percent gains. They are slower, smaller, and usually more consistent gains especially if far out of the money.

For example - when meta was $90, i had 240 contracts on it. Would have made so so so much more if i had just gone all in and bought shares.

Similarly - when mpw was $3, i had some 1600 contracts on it - made 42k on those. But if i had gone all in with 700k, i would have made 350k in 2 months.

Puts limit losses, it’s a risk limiting strategy, protects downside at the expense of an upside. But it can be consistent growth.

Taxes. I wanted long term cap gains at the time i entered these positions. Bad ideaDid you basically go 1 year out because vix became decently high?

Why would you do that when theta decay is extremely inefficient when > 1 year out. I used to do these, but now i am very conscious about not going over 90 days.

for smci: shares because the spreads are too wide for options to my liking for the sizing i wantedDid you have a handful of swing and intraday strategies to time those SMCI entries and exits?

Maybe some combination of indicators and other TA?

What made you choose to do pure shares for your SMCI and AMZN positions rather than selling puts?

I'm only familiar with direct shares trading since that's what I spent two years doing during the pandemic (intraday and multi-day swing momentum trading, entries and exits based on supports/resistances along with a volume analysis approach I came up with)

For amzn: shares with intention to hold for a year (try to get long term cap gains)

- Joined

- Jul 27, 2011

- Messages

- 2,273

- Reaction score

- 2,943

Taxes. I wanted long term cap gains at the time i entered these positions. Bad idea

Selling naked puts even 1 year in advance does not get you long term capital gains, I’ve looked into this. There’s no point in holding a put > 1 year from a tax perspective.

The only way to get long term capital gains on 60 percent of your profit is to sell puts on rut,spx, and whatever the qqq index was. In the case of put selling on indexes like spx and rut, hold time can be 1 second, but you’ll still get 60 percent long term capital gains.

RUT Index Options

S&P 500 Index Options

How Are Futures and Options Taxed?

Learn about the U.S. tax processes of futures and options.

Last edited:

Well. Today i learned. Cost of ignorance/assumptions!Selling puts even 1 year in advance does not get you long term capital gains, I’ve looked into this. There’s no point in holding a put > 1 year from a tax perspective.

The only way to get long term capital gains on 60 percent of your profit is to sell puts on rut,spx, and whatever the qqq index was. In the case of put selling on indexes like spx and rut, hold time can be 1 second, but you’ll still get 60 percent long term capital gains.

RUT Index Options

www.cboe.com

S&P 500 Index Options

www.cboe.com

How Are Futures and Options Taxed?

Learn about the U.S. tax processes of futures and options.www.investopedia.com

- Joined

- Jul 27, 2011

- Messages

- 2,273

- Reaction score

- 2,943

Well. Today i learned. Cost of ignorance/assumptions!

tough day.

Meta missed q2 guideline expectations

Ibm missed

Gdp growth dropped in half of last quarter - 3.4 -> 1.7 (vs 2.4 expected)

Core Pce 3.7 vs 3.4 expected - up from 2

#stagflation

- Joined

- May 6, 2020

- Messages

- 281

- Reaction score

- 667

Yikes, opened up my brokerage accounts and it looks like my avatar picture to the left!

Terrible.

This is where I like to hunt for opportunities.

Terrible.

This is where I like to hunt for opportunities.

With the positive after hours reaction to MSFT GOOGL, my account is now only down -57K for the day. I call that a victory, considering META’s disaster!tough day.

Meta missed q2 guideline expectations

Ibm missed

Gdp growth dropped in half of last quarter - 3.4 -> 1.7 (vs 2.4 expected)

Core Pce 3.7 vs 3.4 expected - up from 2

#stagflation

- Joined

- Jul 27, 2011

- Messages

- 2,273

- Reaction score

- 2,943

With the positive after hours reaction to MSFT GOOGL, my account is now only down -57K for the day. I call that a victory, considering META’s disaster!

ONLY 57k 😂🤣🤣🤣🤣

Down 3700 today lol. You’re in a different league of risk tolerance.

Last edited:

- Joined

- Nov 24, 2002

- Messages

- 23,784

- Reaction score

- 12,298

I have an analogy to give. People that are talking thousands, not millions, say "you can't do it; why wouldn't the big guys be doing it?", because naysayers gonna naysay. So, I play this Star Trek game. One currency is latinum. There's mining for it, to refine it. But, there's a "better" one, concentrated latinum. The returns are 7x better, for the same amount of time. It's not cost effective to mine the lat, if you can refine the conc lat.

The people making individual gains might be a rounding error for the big guys. It's not worth their time.

So, you'll notice, I'll never call it "a lottery" or say "you got lucky" or screech "you can't do it!" Because, indeed, it's done!

The people making individual gains might be a rounding error for the big guys. It's not worth their time.

So, you'll notice, I'll never call it "a lottery" or say "you got lucky" or screech "you can't do it!" Because, indeed, it's done!

In the context of 57k down for 3500k net worth- that’s only a -1.6% drop 😆ONLY 57k 😂🤣🤣🤣🤣

Down 3700 today lol. You’re in a different league of risk tolerance.

- Joined

- Jul 27, 2011

- Messages

- 2,273

- Reaction score

- 2,943

My net worth is at 2M.In the context of 57k down for 3500k net worth- that’s only a -1.6% drop 😆

I somehow find myself more and more anxious about money now that my net worth is growing. It feels like there’s more to lose now, the stakes are higher.

The nicest 1 day unrealized loss i had was around 40-50k. I was at work, could barely concentrate.

Nowadays 5-10k negative days make me anxious. I’m losing my risk tolerance as I’ve made money.

Hmm. Don’t know your situation, for me I think i’d be very uptight if i had spent 30 years saving and investing and going to retire soon. I wouldn’t have the same risk tolerance as today for sureMy net worth is at 2M.

I somehow find myself more and more anxious about money now that my net worth is growing. It feels like there’s more to lose now, the stakes are higher.

The nicest 1 day unrealized loss i had was around 40-50k. I was at work, could barely concentrate.

Nowadays 5-10k negative days make me anxious. I’m losing my risk tolerance as I’ve made money.

I been thinking about my portfolio management plan when i do retire in a couple years. Probably staying in cash and selling safe OTM cash secured puts on SPY or something.

- Joined

- Jul 5, 2020

- Messages

- 4,014

- Reaction score

- 8,716

My net worth is at 2M.

I somehow find myself more and more anxious about money now that my net worth is growing. It feels like there’s more to lose now, the stakes are higher.

The nicest 1 day unrealized loss i had was around 40-50k. I was at work, could barely concentrate.

Nowadays 5-10k negative days make me anxious. I’m losing my risk tolerance as I’ve made money.

Buy bonds and mmf I guess

- Joined

- Jul 27, 2011

- Messages

- 2,273

- Reaction score

- 2,943

Round 2 of mpw:

Locked and loaded with significant increase in position size when steward finally declared bankruptsy. Earnings also coming in, so kind of expecting a clear game plan to be laid out about the replacement of steward with other operators. The steward bankruptsy filing documents actually have stated there are multiple interested parties and one official letter of interest.

Holding 1225 $3 strike contracts, july expiration. Took a hit on the day steward bankruptsy news came out, but if earnings go well, this will more than make up for it. If earnings don’t go well - oh well, delayed gratification, i feel good about $3 strike because of how well it held when things were much worse.

Had 700+ lyft contracts today that were all cashed out - up 13k on lyft today after a volatility crush after earnings went well. The lyft premium collapsed so much that i closed all holdings and went back in ewz, and increased arkk holding size. Went from my biggest loser (negative 8k) to my 3rd biggest winner today.

Sitting at 11% ytd gain. If things go well, should add another 5-6 percent gain in 2 months and 10 days.

Let’s go mpw 🤣🤣🤣🤣

Locked and loaded with significant increase in position size when steward finally declared bankruptsy. Earnings also coming in, so kind of expecting a clear game plan to be laid out about the replacement of steward with other operators. The steward bankruptsy filing documents actually have stated there are multiple interested parties and one official letter of interest.

Holding 1225 $3 strike contracts, july expiration. Took a hit on the day steward bankruptsy news came out, but if earnings go well, this will more than make up for it. If earnings don’t go well - oh well, delayed gratification, i feel good about $3 strike because of how well it held when things were much worse.

Had 700+ lyft contracts today that were all cashed out - up 13k on lyft today after a volatility crush after earnings went well. The lyft premium collapsed so much that i closed all holdings and went back in ewz, and increased arkk holding size. Went from my biggest loser (negative 8k) to my 3rd biggest winner today.

Sitting at 11% ytd gain. If things go well, should add another 5-6 percent gain in 2 months and 10 days.

Let’s go mpw 🤣🤣🤣🤣

Attachments

Last edited:

- Joined

- May 3, 2004

- Messages

- 3,159

- Reaction score

- 3,760

I'm easing my way back in. Still about 75% cash but have about 25% invested. Still watching the market closely. Ultimately, I'm just trying to be patient as none of my entry criteria are green, so I'm just playing it by ear. About 29% gain YTD down 7% past month.

Also, I'm thinking about buying a new house and putting some money down that I intend to take out of my non tax deferred brokerage account so I'm paranoid I'm going to wake up and be down 20% in that account if I just go guns blazing in a market that just had a 5% pull back and has not yet revealed its medium term intentions.

Also, I'm thinking about buying a new house and putting some money down that I intend to take out of my non tax deferred brokerage account so I'm paranoid I'm going to wake up and be down 20% in that account if I just go guns blazing in a market that just had a 5% pull back and has not yet revealed its medium term intentions.

Last edited:

- Joined

- Oct 21, 2008

- Messages

- 6,281

- Reaction score

- 2,538

Don't increase your bet size as your portfolio grows.My net worth is at 2M.

I somehow find myself more and more anxious about money now that my net worth is growing. It feels like there’s more to lose now, the stakes are higher.

The nicest 1 day unrealized loss i had was around 40-50k. I was at work, could barely concentrate.

Nowadays 5-10k negative days make me anxious. I’m losing my risk tolerance as I’ve made money.

If the swings are making you uncomfortable, you're betting too big.

valianteffort

Full Member

- Joined

- Oct 8, 2022

- Messages

- 78

- Reaction score

- 200

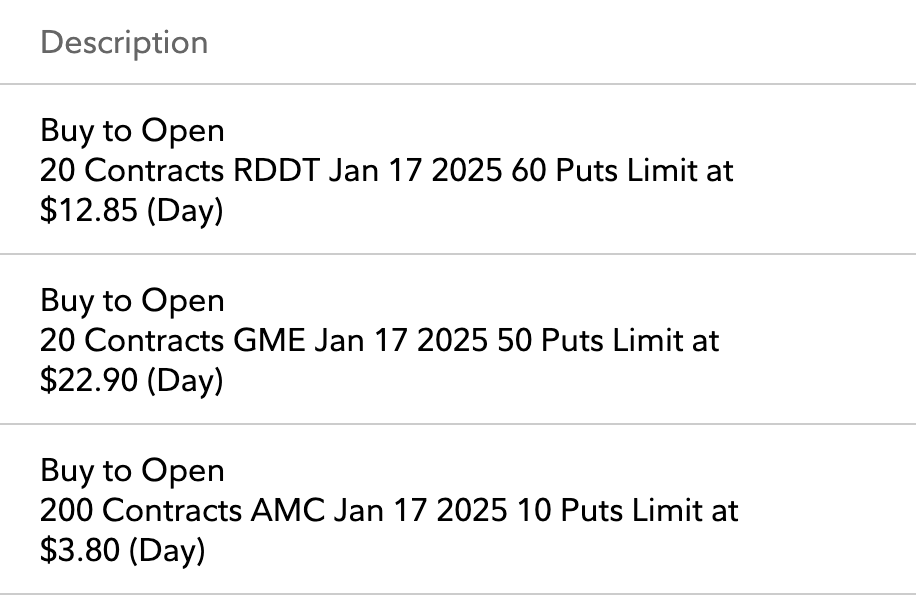

asleep at the wheel and missed the ride up. going to roll the dice on the ride down 🫡

but

but

- Joined

- Jul 12, 2004

- Messages

- 5,289

- Reaction score

- 4,988

Yippersasleep at the wheel and missed the ride up. going to roll the dice on the ride down 🫡View attachment 386744 but

RDDT 25K premium

GME 46K premium

AMC 76K premium

Good luck man! Putting 150K on shorting shiitcos. Just hold to expiration please as IV crush will F you on some of those while you are riding the stock prices down.

The thing with GME...the last time in 2021 it went really high, it took an awful long time for it to come down. I don't like selling call credit spreads that expire months in the future, but it's probably a safer play

You going to sell nearterm puts to help finance those long positions?

Last edited:

valianteffort

Full Member

- Joined

- Oct 8, 2022

- Messages

- 78

- Reaction score

- 200

You are right in that GME took a long while to come down. I just didn't have the cajones to buy short term puts even though I have a feeling CPI will bring the market down tomorrow however meme stocks don't follow the rules. We'll see what happens but in 2-4 weeks time I may decide to take some profit (I have my target numbers) vs letting it ride. Although GME may rocket back up, it will come down. It must come down. IV crush is high but I anticipate a quicker downfall than last round.Yippers

RDDT 25K premium

GME 46K premium

AMC 76K premium

Good luck man! Putting 150K on shorting ****cos. Just hold to expiration please as IV crush will F you on some of those while you are riding the stock prices down.

The thing with GME...the last time in 2021 it went really high, it took an awful long time for it to come down. I don't like selling call credit spreads that expire months in the future, but it's probably a safer play

You going to sell nearterm puts to help finance those long positions?

Wasn't planning on selling near term puts. Whats another year of attending life to finance these positions?

valianteffort

Full Member

- Joined

- Oct 8, 2022

- Messages

- 78

- Reaction score

- 200

Although there is some risk, note that leap options carry significantly less risk and at my age it’s a risk I’m willing to take. Selling and rolling puts on MPW when at near all time lows like OP posted to me is extremely minimal risk with high upside. Buying puts on a stock with a PE ratio of 1200 that expire in Jan 2025 is low risk to me. A meme stock can not sustain levels like this for 8 months. Possible, not probable. These aren’t weekly or ODTE gambles.It’s seriously wild to me that at this income level you guys gamble this recklessly.

Yeah I dunno. I just have no room in my portfolio for speculative investments. I go to Vegas with $300 in my pocket if I want to indulge that, not my brokerage accounts.Although there is some risk, note that leap options carry significantly less risk and at my age it’s a risk I’m willing to take. Selling and rolling puts on MPW when at near all time lows like OP posted to me is extremely minimal risk with high upside. Buying puts on a stock with a PE ratio of 1200 that expire in Jan 2025 is low risk to me. A meme stock can not sustain levels like this for 8 months. Possible, not probable. These aren’t weekly or ODTE gambles.

This is like scratch off lottery tickets for the wealthy. Which begs the question, why??

- Joined

- Jul 12, 2004

- Messages

- 5,289

- Reaction score

- 4,988

It’s seriously wild to me that at this income level you guys gamble this recklessly.

Although there is some risk, note that leap options carry significantly less risk and at my age it’s a risk I’m willing to take. Selling and rolling puts on MPW when at near all time lows like OP posted to me is extremely minimal risk with high upside. Buying puts on a stock with a PE ratio of 1200 that expire in Jan 2025 is low risk to me. A meme stock can not sustain levels like this for 8 months. Possible, not probable. These aren’t weekly or ODTE gambles.

Dude ... it's a lot of money. 150K premium spent shorting three absolutely terrible companies.

Look at GME for example. You have a 50 put with a break even of 27. That's a 44% drop. You need a minimum of a 44% drop to make money on those puts.

The last time GME spiked huge like this was the week of Jan 25, 2021. Now..it opened at 24, had a high of 120, and closed at 81. Let's say puts were bought sometime when spot was between 60-80, so call it 70. For the REST OF 2021 it oscillated between 35-50. That's only a 29 - 50% drop OVER ONE YEAR! There was a brief moment in February where it dropped considerably and one would have made money. But it immediately shot back up and really had a hard time coming down the entire year. So in 2021 it dropped 29-50%, and you need a 44% drop to make money. And that's at expiration and excluding vega fookery that will affect your long position.

So yea spending 150K on this is a shiit ton of money. spending 15K...yea that I can see. But you are spending 1/3 of your yearly earnings on shorting shiitcos as I call them.

Also why I think it's better to short GME by selling long term calls or call spreads. If the option chain beefs up there will be 100 spot strikes and one could sell a 100c, say...6 months out. (or a call spread). Or even better...just short the actual shares then you don't have to worry about the greeks.

valianteffort

Full Member

- Joined

- Oct 8, 2022

- Messages

- 78

- Reaction score

- 200

44% to be in the money at the time of expiration. A long ways away. I have the possibility of GME crashing down this week or next week or the month after. Even a 20% drop tomorrow will raise my option value thousands. With the remaining IV and time the overall option could be up this week, next week, or soon. A cash out at that time is reasonable.Dude ... it's a lot of money. 150K premium spent shorting three absolutely terrible companies.

Look at GME for example. You have a 50 put with a break even of 27. That's a 44% drop. You need a minimum of a 44% drop to make money on those puts.

The last time GME spiked huge like this was the week of Jan 25, 2021. Now..it opened at 24, had a high of 120, and closed at 81. Let's say puts were bought sometime when spot was between 60-80, so call it 70. For the REST OF 2021 it oscillated between 35-50. That's only a 29 - 50% drop OVER ONE YEAR! There was a brief moment in February where it dropped considerably and one would have made money. But it immediately shot back up and really had a hard time coming down the entire year. So in 2021 it dropped 29-50%, and you need a 44% drop to make money. And that's at expiration and excluding vega fookery that will affect your long position.

So yea spending 150K on this is a shiit ton of money. spending 15K...yea that I can see. But you are spending 1/3 of your yearly earnings on shorting shiitcos as I call them.

Also why I think it's better to short GME by selling long term calls or call spreads. If the option chain beefs up there will be 100 spot strikes and one could sell a 100c, say...6 months out. (or a call spread). Or even better...just short the actual shares then you don't have to worry about the greeks.

- Joined

- Jul 27, 2011

- Messages

- 2,273

- Reaction score

- 2,943

Although there is some risk, note that leap options carry significantly less risk and at my age it’s a risk I’m willing to take. Selling and rolling puts on MPW when at near all time lows like OP posted to me is extremely minimal risk with high upside. Buying puts on a stock with a PE ratio of 1200 that expire in Jan 2025 is low risk to me. A meme stock can not sustain levels like this for 8 months. Possible, not probable. These aren’t weekly or ODTE gambles.

Yeah selling mpw puts definitely was minimal risk. Definitely has paid off. Though I’m really going to be milking mpw for a little bit longer. I have 1100 contracts on MPW for $3, I'll be rolling to $3.5 strike sooner or later whenever there's a highly negative day. I also took todays huge increase in price as an opportunity to open a strangle and added 300 calls at $9 strike. Should be able to squeeze out another 10-12k out of MPW in another 2 months.

Ytd mpw has made me 51k so it definitely paid off. The thesis eventually proved correct - Just needed A LOT of patience.

As far as you buying puts is concerned, while in theory I agree that there's 100% going to be a bust where the GME/AMC plummet, and theoretically a leap should mitigate for that risk, but for all you know it might go up 200% before massively plummeting. If in fact it does go up 200%, you could be looking at unrealized losses of tens of thousands of dollars. If you have the balls to hold through that, then yes, you could make a lot of money, assuming this meme mania doesn't last as long as last time - I think it almost took a year to go back to fair value for these meme stocks last time - and that's a big risk for you.

While I'm also making a play on this very high volatility, but in typical cyanide fashion, I'm mitigating risk, playing it EXTREMELY safe, and making sure I get small wins. Today, I sold 100 $2.5 strike AMC puts with 10 Days to expiration. Got $5.5 on average per contract = 5.5/244.5 = 2.2% return in 10 days cash covered. 2.5 is the price below where AMC was hovering prior to the rise - So extremely safe given this new buying interest that will likely buy each dip. I mean...2% in 10 days with 70% downside protection from current price is as low risk as it gets - yet 2% in 10 days is essentially 70% annualized lol - not a bad return eh? I'm going to keep rolling my position 1-2 weeks forward every time I hit 40-50% profitability. Should be able to squeeze out a few thousand dollars.

I'm up 13% so far this year with YTD gain of 93k and on track towards gaining 120k by july. I'll keep taking my small risk mitigated wins rather than trying for a home run. Not looking for glory. Just small risk adjusted wins.

See attached for current portfolio and current YTD gains

Attachments

- Joined

- Jul 27, 2011

- Messages

- 2,273

- Reaction score

- 2,943

Yeah I dunno. I just have no room in my portfolio for speculative investments. I go to Vegas with $300 in my pocket if I want to indulge that, not my brokerage accounts.

This is like scratch off lottery tickets for the wealthy. Which begs the question, why??

It's not really the equivalent of gambling. It's based on sound theory which will absolutely come true. When meme mania will fade, prices will drop. Someone who has bought puts will absolutely benefit from that.

The problem though is figuring out when the drop happens. Now that's the gambling part. Hence I always SELL contracts and receive premium, as I don't want to be paying for theta decay. I want time to be in my favor - not against me. When you do it that way, it's not necessarily a lottery ticket - Just a very educated guess.

For example - lets say you think AMC is a crappy stock - which it is. Fundamentals are terrible. And you think the fair market value is $3. But you know that this meme mania might mean the stock will be above $3 for weeks, if not a few months, then you could sell May 31st $3 puts as an example - 16 days to expiration. $20 per contract = $20/280 = 7% return in 2 weeks. I mean...is this trade really gambling? There's a very high chance of success if you ask me. So is it really gambling?

- Joined

- Jul 27, 2011

- Messages

- 2,273

- Reaction score

- 2,943

asleep at the wheel and missed the ride up. going to roll the dice on the ride down 🫡View attachment 386744 but

By the way....

GME and AMC are crap stocks. I know that. But I wouldn't be betting against RDDT. Fundamentally that stock is extremely strong. Just read the last quarterly report. They smashed earnings significantly above expectations. Their growth rate for users, revenue was definitely incredible. This is a growth stock. The P/E doesn't matter here. Their fair value will be based on their price to sales. A 10 X multiple of revenue when growing at 40% isn't as ridiculous as you would think.

Read this:

Reddit Announces First Quarter 2024 Results

Record user traffic, Daily Active Uniques (“DAUq”) increased 37% to 82.7 million Revenue increased 48% to $243.0 million, nearly doubling growth rate from prior quarter Net loss driven by IPO expenses, first profitable Q1 on an Adjusted EBITDA basis Operating cash flow of $32.1 million and...

valianteffort

Full Member

- Joined

- Oct 8, 2022

- Messages

- 78

- Reaction score

- 200

Appreciate your thoughts on RDDT and love to see others perspective! I love this PUT option the most out of all of them. I think my prediction on its demise (as in hitting the 30s again at some point between now and Jan 2025 now to double my money - not a bankruptcy) is based off its guidance. Here are a few reasons why. I understand its growth was amazing this past quarter compared to last year and the previous quarter. However, they are guiding for the exact same revenue next quarter and EBITDA. The big growth occurred and now and to me is priced in for a stock that is failing to make a profit in a high interest rate environment. Even profitable stocks are getting punished. Predicted yearly profit is in 2026 or so. 48% year over year revenue growth but taking a look at upcoming quarter over quarter will they be able to say this is still a growth stock if guidance is accurate or dare I say a miss? The gap down for a growth stock for losing its growth story AND making no profit can be huge. Lets assume they beat that guidance again with growth, however guide the same values again. I do believe the stock has to be punished some even for this with a price in the 60s. My break even is around 47 or less. Insiders sold huge amounts in the 10s of millions at a stock price of 32. Im sure this was preplanned but I strongly believe reddit is riding an IPO hype train and I will reload puts if it gets back to 70s again as well.By the way....

GME and AMC are crap stocks. I know that. But I wouldn't be betting against RDDT. Fundamentally that stock is extremely strong. Just read the last quarterly report. They smashed earnings significantly above expectations. Their growth rate for users, revenue was definitely incredible. This is a growth stock. The P/E doesn't matter here. Their fair value will be based on their price to sales. A 10 X multiple of revenue when growing at 40% isn't as ridiculous as you would think.

Read this:

Reddit Announces First Quarter 2024 Results

Record user traffic, Daily Active Uniques (“DAUq”) increased 37% to 82.7 million Revenue increased 48% to $243.0 million, nearly doubling growth rate from prior quarter Net loss driven by IPO expenses, first profitable Q1 on an Adjusted EBITDA basis Operating cash flow of $32.1 million and...investor.redditinc.com

One additional note, RDDT rallied the last 2 days because of GME and AMC. An immediate reversal when GME and AMC fall is imminent.

Last edited:

- Joined

- Jul 27, 2011

- Messages

- 2,273

- Reaction score

- 2,943

Premarket negative 9 percent amc. Negative 10 percent gme. Negative 3 percent rddt. Looks like you’re about to make a decent chunk of money. What profit percentage do you plan to sell and close at?Appreciate your thoughts on RDDT and love to see others perspective! I love this PUT option the most out of all of them. I think my prediction on its demise (as in hitting the 30s again at some point between now and Jan 2025 now to double my money - not a bankruptcy) is based off its guidance. Here are a few reasons why. I understand its growth was amazing this past quarter compared to last year and the previous quarter. However, they are guiding for the exact same revenue next quarter and EBITDA. The big growth occurred and now and to me is priced in for a stock that is failing to make a profit in a high interest rate environment. Even profitable stocks are getting punished. Predicted yearly profit is in 2026 or so. 48% year over year revenue growth but taking a look at upcoming quarter over quarter will they be able to say this is still a growth stock if guidance is accurate or dare I say a miss? The gap down for a growth stock for losing its growth story AND making no profit can be huge. Lets assume they beat that guidance again with growth, however guide the same values again. I do believe the stock has to be punished some even for this with a price in the 60s. My break even is around 47 or less. Insiders sold huge amounts in the 10s of millions at a stock price of 32. Im sure this was preplanned but I strongly believe reddit is riding an IPO hype train and I will reload puts if it gets back to 70s again as well.

One additional note, RDDT rallied the last 2 days because of GME and AMC. An immediate reversal when GME and AMC fall is imminent.

On the other hand, I’ll probably increase my $2.5 strike 9 day position if premium spikes up a lot.

It's not really the equivalent of gambling. It's based on sound theory which will absolutely come true. When meme mania will fade, prices will drop. Someone who has bought puts will absolutely benefit from that.

The problem though is figuring out when the drop happens. Now that's the gambling part. Hence I always SELL contracts and receive premium, as I don't want to be paying for theta decay. I want time to be in my favor - not against me. When you do it that way, it's not necessarily a lottery ticket - Just a very educated guess.

For example - lets say you think AMC is a crappy stock - which it is. Fundamentals are terrible. And you think the fair market value is $3. But you know that this meme mania might mean the stock will be above $3 for weeks, if not a few months, then you could sell May 31st $3 puts as an example - 16 days to expiration. $20 per contract = $20/280 = 7% return in 2 weeks. I mean...is this trade really gambling? There's a very high chance of success if you ask me. So is it really gambling?

Yes, it’s speculative gambling. It is zero sum. There is a winner and a loser on every position. It doesn’t matter if there’s a “high chance of success”. A money line bet of -900 will “win” 9/10 but it’s still straight gambling. This is what you are doing and why you convince yourself that you have a “system” rather than gambling.

The fact that you and others on this thread fail to understand the very basic difference between investing in revenue generating assets (stocks, bonds, real estate, small business, etc), and speculative gambles (options trading, day trading, forex, penny stocks, sports gambling, roulette, etc) is shocking with the money you are throwing around.

valianteffort

Full Member

- Joined

- Oct 8, 2022

- Messages

- 78

- Reaction score

- 200

Closed the AMC and GME positions. Down 30% and 25% were good enough for me! AMC closed + 49k and GME + 16k. Weekly options would have retired me on this one 😅😅 but I wouldn’t dare have tried.Premarket negative 9 percent amc. Negative 10 percent gme. Negative 3 percent rddt. Looks like you’re about to make a decent chunk of money. What profit percentage do you plan to sell and close at?

On the other hand, I’ll probably increase my $2.5 strike 9 day position if premium spikes up a lot.

Holding Reddit puts still. + 14%

Give away a shift and spend that day drinking with buddies. Nice profit.Closed the AMC and GME positions. Down 30% and 25% were good enough for me! AMC closed + 49k and GME + 16k. Weekly options would have retired me on this one 😅😅 but I wouldn’t dare have tried.

Holding Reddit puts still. + 14%

valianteffort

Full Member

- Joined

- Oct 8, 2022

- Messages

- 78

- Reaction score

- 200

Respectfully, is investing in a stock not also a zero sum game? Is there not a winner and a loser when your invested position is being shorted out by your brokerage? The risk is just less to buy the stock. As you hold an ETF or the SP500 for longer, your chance of profit increases tremendously. As my options date extends later and later, my chance of profit also increases. I think its all risk. Small businesses can flounder in a bad high interest rate economy. Your entire investment could go to 0 if you pick the wrong small business. Real estate is 'due for a crash'. I've thought about buying a property and renting it out. But do I really want to deal with another client while I'm at home when we do that for work 120-140 hours per month? Your view is similar to a lot of people and I see that side. Fortunately with our careers in ER we are allowed to increase our risk past some whom may not have a higher income. This was just out and Im sticking with it!Yes, it’s speculative gambling. It is zero sum. There is a winner and a loser on every position. It doesn’t matter if there’s a “high chance of success”. A money line bet of -900 will “win” 9/10 but it’s still straight gambling. This is what you are doing and why you convince yourself that you have a “system” rather than gambling.

The fact that you and others on this thread fail to understand the very basic difference between investing in revenue generating assets (stocks, bonds, real estate, small business, etc), and speculative gambles (options trading, day trading, forex, penny stocks, sports gambling, roulette, etc) is shocking with the money you are throwing around.

You are conflating two types of risk. Long term stocks are NOT zero sum because they generate revenue! They are literally wealth creating. The wealth is created when the customer gives the business money and they BOTH become economically wealthier (both parties got what they wanted and became better off. No one lost.)Respectfully, is investing in a stock not also a zero sum game? Is there not a winner and a loser when your invested position is being shorted out by your brokerage? The risk is just less to buy the stock. As you hold an ETF or the SP500 for longer, your chance of profit increases tremendously. As my options date extends later and later, my chance of profit also increases. I think its all risk. Small businesses can flounder in a bad high interest rate economy. Your entire investment could go to 0 if you pick the wrong small business. Real estate is 'due for a crash'. I've thought about buying a property and renting it out. But do I really want to deal with another client while I'm at home when we do that for work 120-140 hours per month? Your view is similar to a lot of people and I see that side. Fortunately with our careers in ER we are allowed to increase our risk past some whom may not have a higher income. This was just out and Im sticking with it!

I’m glad you came out way ahead on this one but please understand the difference before doing any more of this.

Last edited:

- Joined

- Jul 27, 2011

- Messages

- 2,273

- Reaction score

- 2,943

Your are conflating two types of risk. Long term stocks are NOT zero sum because they generate revenue! They are literally wealth creating. The wealth is created when the customer gives the business money and they BOTH become economically wealthier (both parties got what they wanted and became better off. No one lost.)

I’m glad you came our way ahead on this one but please understand the difference before doing any more of this.

the option trades are on the same companies creating revenue. Unless you deeply understand the benefits of premium harvesting, you will not understand how put selling has one of the best risk adjusted returns.

Now you can say it’s a 0 sum game because someone else has to lose on the other end - sure. Someone has to lose on the other end.

But assuming a fixed number of shares, someone has to buy your stock for a higher price for you to make any money as well. And that needs to keep on happening again and again and again - until eventually 500 years later that company goes bust and gets replaced by other companies and eventually there’s a bag holder (0 sum game) - someone has to lose eventually.

So I’m not sure what you’re saying when there’s decades of research showing put selling being one of the best risk adjusted returns. It’s a fact.

Also these are statements that someone who doesn’t understand what i do would make. Each trade might be a zero sum game. But a trade is only the beginning of a series of trades - eventually, in a down market, a put seller is better off than the person holding the underlying. And that’s also a fact.

Simple question - as a put seller, one of the things i get paid for is time. Theta always decays. It’s a constant. I know tomorrow will be another day. So how am i playing this game incorrectly when i get paid for each day to pass? Literally….i get paid for time to go by as a premium seller. Selling premium is actually the least uncertain way to create wealth since you get paid for an event that just always happens.

- Joined

- Jul 27, 2011

- Messages

- 2,273

- Reaction score

- 2,943

Congratulations.Closed the AMC and GME positions. Down 30% and 25% were good enough for me! AMC closed + 49k and GME + 16k. Weekly options would have retired me on this one 😅😅 but I wouldn’t dare have tried.

Holding Reddit puts still. + 14%

Take the win. Close. Walk away. 😂

Cyanide, you are constantly underplaying the unstated risks of your investments whether option selling or real estate syndications. (Though at least your syndications are actual investments, you just bury your head in the sand when questioned what extra risk you are taking to earn that extra 10% over equities). I’m sure at least at some point you realized that selling puts is an actual contractual obligation that you are on the hook for? It’s not just an easy payday with risk associated with it. I know I won’t convince you because look at all your easy winners from your -9900 money lines! Surely that 1/100 event either won’t happen or won’t be that bad…right? Wall Street, just like Vegas, doesn’t make money on one sided gambles. They take both sides of the bet and make money on fees. When they DO gamble, it’s because of information or technology asynchrony.the option trades are on the same companies creating revenue. Unless you deeply understand the benefits of premium harvesting, you will not understand how put selling has one of the best risk adjusted returns.

Now you can say it’s a 0 sum game because someone else has to lose on the other end - sure. Someone has to lose on the other end.

But assuming a fixed number of shares, someone has to buy your stock for a higher price for you to make any money as well. And that needs to keep on happening again and again and again - until eventually 500 years later that company goes bust and gets replaced by other companies and eventually there’s a bag holder (0 sum game) - someone has to lose eventually.

So I’m not sure what you’re saying when there’s decades of research showing put selling being one of the best risk adjusted returns. It’s a fact.

Also these are statements that someone who doesn’t understand what i do would make. Each trade might be a zero sum game. But a trade is only the beginning of a series of trades - eventually, in a down market, a put seller is better off than the person holding the underlying. And that’s also a fact.

Simple question - as a put seller, one of the things i get paid for is time. Theta always decays. It’s a constant. I know tomorrow will be another day. So how am i playing this game incorrectly when i get paid for each day to pass? Literally….i get paid for time to go by as a premium seller. Selling premium is actually the least uncertain way to create wealth since you get paid for an event that just always happens.

You still clearly don’t understand wealth generation. When a stock eventually goes to zero/bust, the price when changing hands was zero sum, but the wealth generation/dividends/asset sales over the years were NOT. It was wealth created.

Last edited:

- Joined

- Nov 24, 2002

- Messages

- 23,784

- Reaction score

- 12,298

Gambling is random. Calling it that is fundamentally incorrect.

In the short term (a few years or less), so are equity markets.Gambling is random. Calling it that is fundamentally incorrect.

- Joined

- Jul 27, 2011

- Messages

- 2,273

- Reaction score

- 2,943

Cyanide, you are constantly underplaying the unstated risks of your investments whether option selling or real estate syndications. (Though at least your syndications are actual investments, you just bury your head in the sand when questioned what extra risk you are taking to earn that extra 10% over equities). I’m sure at least at some point you realized that selling puts is an actual contractual obligation that you are on the hook for? It’s not just an easy payday with risk associated with it. I know I won’t convince you because look at all your easy winners from your -9900 money lines! Surely that 1/100 event either won’t happen or won’t be that bad…right? Wall Street, just like Vegas, doesn’t make money on one sided gambles. They take both sides of the bet and make money on fees. When they DO gamble, it’s because of information or technology asynchrony.

You still clearly don’t understand wealth generation. When a stock eventually goes to zero/bust, the price when changing hands was zero sum, but the wealth generation/dividends/asset sales over the years were NOT. It was wealth created.

*sigh*...

I'm going to try my best to help you understand how selling premium works. You might not change your mind, that's okay. But hopefully it's education to a few people.

First:

Read this article - https://seekingalpha.com/article/4210320-selling-puts-good-bad-and-ugly

So a put contract infact can be used as a vehicle of investment - essentially, my trades are not meant as a 1 off 45-90 day trade. These are positions, that fundamentally behave in a similar way to owning the actual company. Stock of company X goes up, put seller makes a profit, stock of company X goes down, put seller usually negative, though usually less negative than outright owning the underlying.

Now here's how trading works:

Lets say you're trading EWZ like me (I currently hold 515 contracts of EWZ) for $27 strike 64 days to expiration.

So lets say you sold 515 contracts like me, collected $23 per contract on average ~ 12k. 64 days to expiration. Todays price $31.63.

Lets assume 3 possible scenarios - EWZ goes up 10% in 2 weeks, stays the same in 2 weeks, goes down by 10% in 2 weeks (june 1st - 50 days to expiration).

1) EWZ goes up 10% - From $31.63 -> 34.8 on June 1st. See attached. I will have a 97% gain on my position if stable volatility, a gain of 11.7k. Great. But I'm not done, I roll up the strike to $29 keeping the same expiration. And play the game again.

2) Nothing happens in 2 weeks - Great. See attached. I gain 58.5% assuming stable volatility- so 7k profit. > 50% profit achieved. I roll forward in time another 2 weeks to again add another few thousand potential premium and do the same thing again.

3) EWZ goes down 10% in 2 weeks - From 31.63 -> 28.5. I lose 200% of premium - See attached. So 24k loss. My account happens to have 690k in it right now, so a 10% drop in EWZ results in a 24/690 = 3.4% drop in my account value. So, I definitely didn't lose 10% (risk mitigation of puts). In fact, If I had owned 51500 (515 contracts) shares of EWZ at todays price of $31.63, I would have paid $1.63 million dollars and losing 10% of that in 2 weeks would have been a drop of 160K. So...me holding 515 put contracts significantly far out of the money turns out is still lower risk despite the naked nature of the contract aka leverage. But hey...24k loss - Thats still gotta hurt right? Scroll below to see what needs to be done.

So what now?

I'm holding a bad position. It's dangerously close to my strike. There's 50 days left to expiration (since 2 weeks passed). I don't ever want to be in the money....So what do I do? I roll. And I keep on rolling until I win. Here's how:

I will roll my current position and add time. I will use that time value and drop my strike lower. The further out position will have a higher premium, I will use that higher premium to pay off my first contract. Here's what that would look like - Almost always this will be a positive roll where I will in fact add more net premium even after paying off the original contracts I hold. Of note, the screenshot below only shows the trades conceptually, the exact pricing isn't accurate right now because of this being afterhours - after market opens I could show how much extra premium I'd get. But in one sweep, I get more premium, and drop my strike to $25. This move officially closes the initial obligation, and uses the money from the second contract (new obligation) to pay off the first obligation. Because time is money and there's value in time, the second contract because it is further out had a higher premium than the first contract, resulting in a NET gain in premium. The losses you keep talking about, yeah they happen all the time - Great! I realized that loss, and I'm back at another high probability play with a lower strike. I just eventually need to win. If i win the second trade - i get all the losses covered and then profit on top.

Lets say EWZ drops another 10% from 28.5 to $25.6 in 1 month. I again suffer another BIG decline in account value. I realize that loss AGAIN, and do the same thing. This time exchanging my Sep position for something like January - while dropping strike to $23 or so. In fact, if I have other holdings, chances are I've closed all of them and started concentrating - The idea is that the bigger my loss is, the better the entry point for a bigger position.

Anyway, the point is, worst case scenario, I can extend time to 2 years out. And I can keep on extending. I can even drop the number of contracts with each roll or I can quite simply just drop the strike and instead of a net positive roll do a net negative premium roll and decrease my eventual gain. And guess what....EWZ eventually just has to close above my strike of 23 or whatever it is. It doesn't have to go above 31.63 for me to become profitable. As long as it's above my strike as theta decays, I will win it all. So, it can be at 26 by January in our example, then not only all my losses have been covered, but my account has gained all the premium value too despite EWZ being down at 26 from todays price of 31.63. In essence - in this situation, i gained wealth, while the equity holder lost wealth as the equity value dropped (but it stayed above my strike for my wealth to increase).

Heck, I could do the thing like the seeking alpha article and at some point just hold my strike, and just keep rolling after every 21 days - fundamentally the same as holding the ETF except you get paid in premium for recovery.

Put sellers usually win EVENTUALLY. we have time on our side. Each trade is 0 sum. But a series of trades over years and years is not 0 sum because one of major determinants of premium is time. Time is a fixed constant. And I get paid for it. And it only benefits the seller and goes against the buyer. Again, if one person is paying the other person every day a fixed amount (theta decay), then assuming both sellers and buyers have equal chances of success (zero sum), then the person paying the daily fee will be worse off than the person receiving the daily fee. Now that's just math

cheers.

Edit: And you know...please don't tell me I don't know how wealth is created. I've probably read 50+ finance books. I literally read every finance book at my local library. I read balance sheets for fun. I read offering memorandums from companies for fun. All i do is consume finance. I've read the entire bogleheads series, I'm 100% aware of what a perfect modern portfolio theory based portfolio looks like, I'm perfectly aware of what a 3 fund portfolio looks like and I'm perfectly aware of what factor investing looks like with small cap/value/momentum tilts. And after knowing ALLLLLL of that - this is what I choose to do. You know why? Because the valuation metrics are terrible for US markets. SPY price to book ratio is still incredibly high.

The buffet indicator (US stock value/GDP) is sky high.

Buffett Indicator Shows Stock Market is Strongly Overvalued

The Buffett Indicator is currently 60.88% higher than its historical average, signifying that the stock market is Strongly Overvalued.

Shiller ratios are sky high

Shiller PE Ratio - Multpl

Shiller PE Ratio chart, historic, and current data. Current Shiller PE Ratio is 34.74, a change of +0.40 from previous market close.

www.multpl.com

The US debt is spiraling out of control. The Dollar is slowly losing market share as the currency of global trade. Oil is no longer 100% exclusively being traded with USD. Trillions is added to US debt each year with no political motivation to fix the issue - the US debt will only worsen as high interest rate means that all the treasury debt will be pretty damn expensive going forward as well. Everything is suggesting low-ish returns over the next decade right now. The government is literally in a Ponzi scheme of taking bigger and bigger loans (treasuries) while printing new money to pay off old loans.

The US market has had a 20 year bull run. In the last 100 years did you know there were 4 full decades that were slightly negative? I will not be surprised at all if there's a relatively flat stock market as values normalize over time. And hence I'm a put seller. I know EXACTLY what my gain will be, I'm not dependent on a stock going up for WEALTH CREATION as you mention. In fact, even if things go slightly down, I'll likely still increase wealth. My wealth creation actually only requires time to go by. Your wealth creation actually requires markets to go up - mine doesnt

I pray for your sake that the US stock market isn't the next Japanese stock market.

Last edited:

@cyanide12345678

Excellent post about your put-selling strategy. I study a bit from good futures / options traders and they're very intelligent people -- very mathematically inclined. Personally, it's not my cup of tea as it's horrendously tax inefficient.

Why do you keep rolling contracts every 2 weeks? Why do you try to avoid having ITM or ATM contracts?

You are understating the risk of selling naked puts when you try to frame it nominally. You lost 200% of premium when the stock owner lost 10%. You are reducing risk because of good position sizing. It would be a good idea to go into that so someone whom decides to copy you won't blow up their account.

Essentially there will be larger supply of $. Why will increased supply of $ result in low-ish return of relative scarce asset? FYI, you should be hoping stocks go up. Because as a put seller of stocks, your profit increases if the underlying stock increases. Sure, you're also making money from theta decay but that also applies if you sell puts in non-stock assets.

It's unlikely US stock market will be like Japanese stock market. What happened to the Japanese was due to Plaza Accord. US is stronger country than Japan and can make Japan commit seppuku to boost US economy. No country can do to US what US did to Japan. Power imbalances between countries exist and there is a reason that US stocks outperformed non-US stocks for a long time. Some die-hard indexers are still waiting for when international stocks starting outperforming. Lol.

Excellent post about your put-selling strategy. I study a bit from good futures / options traders and they're very intelligent people -- very mathematically inclined. Personally, it's not my cup of tea as it's horrendously tax inefficient.

Why do you keep rolling contracts every 2 weeks? Why do you try to avoid having ITM or ATM contracts?

3) EWZ goes down 10% in 2 weeks - From 31.63 -> 28.5. I lose 200% of premium - See attached. So 24k loss. My account happens to have 690k in it right now, so a 10% drop in EWZ results in a 24/690 = 3.4% drop in my account value. So, I definitely didn't lose 10% (risk mitigation of puts). In fact, If I had owned 51500 (515 contracts) shares of EWZ at todays price of $31.63, I would have paid $1.63 million dollars and losing 10% of that in 2 weeks would have been a drop of 160K. So...me holding 515 put contracts significantly far out of the money turns out is still lower risk despite the naked nature of the contract aka leverage. But hey...24k loss - Thats still gotta hurt right?

You are understating the risk of selling naked puts when you try to frame it nominally. You lost 200% of premium when the stock owner lost 10%. You are reducing risk because of good position sizing. It would be a good idea to go into that so someone whom decides to copy you won't blow up their account.

The US debt is spiraling out of control. The Dollar is slowly losing market share as the currency of global trade. Oil is no longer 100% exclusively being traded with USD. Trillions is added to US debt each year with no political motivation to fix the issue - the US debt will only worsen as high interest rate means that all the treasury debt will be pretty damn expensive going forward as well. Everything is suggesting low-ish returns over the next decade right now. The government is literally in a Ponzi scheme of taking bigger and bigger loans (treasuries) while printing new money to pay off old loans.

Essentially there will be larger supply of $. Why will increased supply of $ result in low-ish return of relative scarce asset? FYI, you should be hoping stocks go up. Because as a put seller of stocks, your profit increases if the underlying stock increases. Sure, you're also making money from theta decay but that also applies if you sell puts in non-stock assets.

I pray for your sake that the US stock market isn't the next Japanese stock market.

It's unlikely US stock market will be like Japanese stock market. What happened to the Japanese was due to Plaza Accord. US is stronger country than Japan and can make Japan commit seppuku to boost US economy. No country can do to US what US did to Japan. Power imbalances between countries exist and there is a reason that US stocks outperformed non-US stocks for a long time. Some die-hard indexers are still waiting for when international stocks starting outperforming. Lol.

Nice, so you employ a modified Martingale System for your gambling. Glad it’s working out for you. You can manage risk as much as you want and keep stretching that money line, but it’s still going to be gambling at the end of the day.

I’ll call you out for not understanding the concept wealth generation because you don’t and still don’t. Investing in the Nikkei 225 through the 90s and 2000s wouldn’t leave you flat, because dividends have been paid out. Again, companies generate revenue and create wealth. Many companies I hold purposefully do not go up and are dividend producing. I think you would be surprised how well you do through a “flat” market with compounding interest and time. Swing and a miss for you again on a basic concept.

I will use a really simple analogy that is actually not an analogy at all because it is exactly what happens with the stock market on a micro level. If I bought into a SDG at $200k, worked there for 10 years making $50k/yr above market rate, then the contract got sniped by a CMG, how did I do? By your logic I did TERRIBLE. Zero sum! Lost money! But the business actually made me $300k net. The price of the asset is only one peice of the pie. Your entire world view revolves around the price of the stock going up and down as opposed to the revenue creation. (Which doesn’t surprise me because that’s how gamblers view the market.) I would LOVE if the global markets stayed flat for the next 20 years (even better if they went down!). Much cheaper for me to keep capturing the revenues generated during my working years.

I will say again that I know I will never convince you. I am trying to help the dozens of other people on this forum make smart financial decisions and understand the fundamentals of investing vs gambling.

Edit: I realize now you are conflating personal wealth acquisition with the economic concept of wealth CREATION, where new wealth is actually created in the system. I am talking about the latter. It’s a very important concept because it is what separates investments from speculation.

This is very important to understand, because otherwise you think I’m just being a jerk. The long term expected return in gambling/speculative investments is zero (and actually negative when you account for taxes and fees). The long term expected return in a wealth creating investment can actually be positive. That is the beauty of the stock market, real estate market, franchising, etc. Risk and gambling are NOT the same thing even though gamblers frequently try to mix them up in their arguments to mean the same thing. It’s about mathematical expected return based on probabilities.

You can create many gambling systems that look great for awhile. For example, I could bet on 31 numbers at a time on roulette over and over. And then apply a martingale system the rare times I lost. I would almost ALWAYS make little bits of money over and over again. I would look like a winner. But my long term mathematical return is STILL zero!! This is you and your options trading system. You aren’t being paid for “time”. You’re being paid to hold onto risk. You are taking the other side of a bet.

I’ll call you out for not understanding the concept wealth generation because you don’t and still don’t. Investing in the Nikkei 225 through the 90s and 2000s wouldn’t leave you flat, because dividends have been paid out. Again, companies generate revenue and create wealth. Many companies I hold purposefully do not go up and are dividend producing. I think you would be surprised how well you do through a “flat” market with compounding interest and time. Swing and a miss for you again on a basic concept.

I will use a really simple analogy that is actually not an analogy at all because it is exactly what happens with the stock market on a micro level. If I bought into a SDG at $200k, worked there for 10 years making $50k/yr above market rate, then the contract got sniped by a CMG, how did I do? By your logic I did TERRIBLE. Zero sum! Lost money! But the business actually made me $300k net. The price of the asset is only one peice of the pie. Your entire world view revolves around the price of the stock going up and down as opposed to the revenue creation. (Which doesn’t surprise me because that’s how gamblers view the market.) I would LOVE if the global markets stayed flat for the next 20 years (even better if they went down!). Much cheaper for me to keep capturing the revenues generated during my working years.

I will say again that I know I will never convince you. I am trying to help the dozens of other people on this forum make smart financial decisions and understand the fundamentals of investing vs gambling.

Edit: I realize now you are conflating personal wealth acquisition with the economic concept of wealth CREATION, where new wealth is actually created in the system. I am talking about the latter. It’s a very important concept because it is what separates investments from speculation.

This is very important to understand, because otherwise you think I’m just being a jerk. The long term expected return in gambling/speculative investments is zero (and actually negative when you account for taxes and fees). The long term expected return in a wealth creating investment can actually be positive. That is the beauty of the stock market, real estate market, franchising, etc. Risk and gambling are NOT the same thing even though gamblers frequently try to mix them up in their arguments to mean the same thing. It’s about mathematical expected return based on probabilities.

You can create many gambling systems that look great for awhile. For example, I could bet on 31 numbers at a time on roulette over and over. And then apply a martingale system the rare times I lost. I would almost ALWAYS make little bits of money over and over again. I would look like a winner. But my long term mathematical return is STILL zero!! This is you and your options trading system. You aren’t being paid for “time”. You’re being paid to hold onto risk. You are taking the other side of a bet.

Last edited:

Similar threads

- Replies

- 183

- Views

- 12K